How to become a Crorepati with just Rs 5,000 a month? Previously I told you on 21 years plan to invest just 5,000 Rupees per month and get more than one crore rupees in hand. Now I have reviewed and revised that plan for becoming crorepati in just 15 years instead of 21 years, year 2021 update for Indian investor. Yes, a you can invest wisely and become a crorepati before the age of 40, that too in India. Read this post carefully for that.

I know you and me are not expert in share market nor in establishing a business which will make you crorpati in lifetime!

I know you don’t have lakhs of rupees to invest at a time.

But for sure I know that you can invest small amounts per month regularly which will grow your money in the time duration to meet your ambitious long-term goals

So don’t wait to collect money to invest, but take your decision NOW. Don not defer the investment plan indefinitely but start it TODAY.

You will be surprised to know that investing amount as small as Rs 5,000 through a monthly Systematic Investment Plan (SIP) in an equity scheme (linked to share market) will help you to generate a corpus of Rs 1 crore in just a little over 20 years.

Investing via monthly SIP of Rs 5,000 to get 1 crore Rupees

As said earlier share market is the only thing where you can appreciate your money over long term. So investing money in an equity market via mutual funds is one of the best option to choose for.

NOTE : Mutual fund investments are subject to market risks. Please read the offer document carefully before investing

Investing in an equity mutual fund scheme via an SIP is the best way to achieve your long-term goals.

As observed over years, Equity has the potential to grow and give you superior returns than other asset classes.

It may be used to beat inflation which is essential to achieve long-term goals and help you financially over the time period.

One more advantage you get is to enjoy favorable taxation. As you know that any long-term capital gains tax on investments held over a year are tax-free.

All the calculations shown below are considering that you will be able to invest a small amount of Rs 5,000 every month, by investing that amount in a Mutual Fund SIP in equity mutual funds.

Take help from an expert : If you are not versed with mutual funds, take help from local investment consultant for selecting schemes, or alternatively you may check famous websites such as moneycontrol to get an insight to pick a portfolio based on your risk appetite and SIP amount.

Assume 12% returs (safely) : Considering a long term perspective of 20 years, your portfolio shall be able to deliver an annual return of 12 percent, which in tern will able to generate a corpus of Rs 1 crore in 20-21 years.

Although this is not the best and an ideal way to invest, at least it will work even when you are not a share market expert, and investing over long term generally reduces the risk.

Tip: Even the markets flutuates from up to down, do not discontinue your investment plan, keep consistently pumping that small amount in funds and you should achieve the goal.

Increasing SIP amount every year

As each year you will get small increments in your salary, so to reduce time to become crorpati you can start increasing your SIP monthly amount by 10% each year.

That means first year your SIP amount is 5,000 Rupees per month.

Second year the SIP amount per month will become 5,000 + 10% of 5,000 = 5,000 + 500 = 5,500 Rs

Third year the SIP amount per month will become 5,500 + 10% of 5,500 = 5,500 + 550 = 6,050 Rs

And so on.

Here is tabular reproduction of what will happen over next 20 years with your investment assuming an annual return of 12 percent for calculation. ( Returns 12% per Annum considered for safe calculations )

Table shows how you will be able to meet your target corpus of Rs 1 core in 21 years.

See table below.

| Year | SIP Amount INR | SIP value at the end of the year | SIP value at the end of 21 years |

| 1 | 5,000 | 64,047 | 6,17,813 |

| 2 | 5,500 | 70,451 | 6,06,780 |

| 3 | 6,050 | 77,496 | 5,95,945 |

| 4 | 6,655 | 85,246 | 5,85,303 |

| 5 | 7,321 | 93,771 | 5,74,851 |

| 6 | 8,053 | 103,148 | 5,64,586 |

| 7 | 8,858 | 1,13,463 | 5,54,504 |

| 8 | 9,744 | 1,24,809 | 5,44,602 |

| 9 | 10,718 | 1,37,290 | 5,34,877 |

| 10 | 11,790 | 1,51,019 | 5,25,326 |

| 11 | 12,969 | 1,66,120 | 5,15,945 |

| 12 | 14,266 | 1,82,733 | 5,06,732 |

| 13 | 15,692 | 2,01,006 | 4,97,683 |

| 14 | 17,261 | 2,21,106 | 4,88,796 |

| 15 | 18,987 | 2,43,217 | 4,80,067 |

| 16 | 20,886 | 2,67,539 | 4,71,495 |

| 17 | 22,975 | 2,94,293 | 4,63,075 |

| 18 | 25,272 | 3,23,722 | 4,54,806 |

| 19 | 27,800 | 3,56,094 | 4,46,684 |

| 20 | 30,580 | 3,91,703 | 4,38,708 |

| 21 | 33,637 | 4,30,874 | 4,30,874 |

| Total SIP Value at end of 21 years | 1,08,99,452 | ||

Don’t forget to Keep track of your investments

Yes, keep observing what is happening with the fund performance, if needed you may like to switch over funds depending upon the performance, however keep in mind not to do it frequently, but after each year is important.

If the scheme is performing as per expectations and the rating given to the scheme is Five stars, then you may please continue in that scheme.

If the scheme fails to perform of reduces in its ratings then you may like to check and switch the amount to any other better performing company.

Generally you get comprehensive idea and comparison charts on famous websites on funds performance year over years so best to go with brands which are present over last 10-15 years and have experience and expertise to manage large funds.

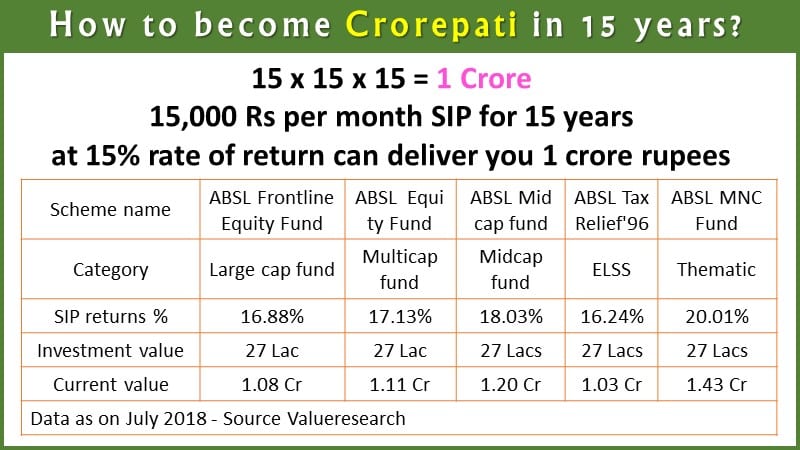

Revised plan for 15 years crorpati [2021 plan]

15,000 Rs per month SIP for 15 years at 15% rate of return can deliver you 1 crore rupees.

The plan is revised based on performance of funds in July 2018, data collection from Valueresearch for preparing the below table.

| Scheme name | ABSL Frontline Equity Fund | ABSL Equity Fund | ABSL Mid cap fund | ABSL Tax Relief’96 | ABSL MNC Fund |

| Category | Large cap fund | Multicap fund | Midcap fund | ELSS | Thematic |

| SIP returns % | 16.88% | 17.13% | 18.03% | 16.24% | 20.01% |

| Investment value | 27 Lac | 27 Lac | 27 Lacs | 27 Lacs | 27 Lacs |

| Current value | 1.08 Cr | 1.11 Cr | 1.20 Cr | 1.03 Cr | 1.43 Cr |

| Data as on July 2018 – Source Valueresearch | |||||

Its clear that if you consistently put an effort in investment over a long time span, it will yield you good results, all you have to do it keep patience and not change the plans frequently.

Remember that slow and steady wins the race is till true even in the year 2021.

If you have any doubts in this post, feel free to comment below the post and I will try to answer them as and when time permits.

Happy investing for your bright future.

Invest wisely.

Hope this helps.

Leave a Reply Cancel reply